Thailand Temporary Employment Outsourcing yto2th

PEO Services means your recruited people are temporarily being recruited by Evershine Bangkok , due to some reasons, your Parent company not yet set up foreign-owned subsidiary in Thailand , but there is a demand for staff. The services will arrange your recruited staff in the way to comply with Thailand’ salary, labor and individual income tax laws and regulations

E-mail: yto2th@evershinecpa.com

Manager Cindy Victoria Speak in Bahasa, English, and Chinese.

Whats App +886-989-808-249

wechatid: victoria141193

If your company doesn’t want to set up an WFOE (Wholly Foreign Owned Entity) in Thailand, but you will recruit employees temporarily or by project base, we suggest you adopt our Thailand Temporary Employment Outsourcing.

It means Evershine will recruit your overseas expatriates or Thailand local staff on behalf of your company.

And then we will take care of all kinds of relevant local services including of payroll compliance and expenditure process.

Besides, Evershine will fully comply with Thailand law and regulations on individual Tax, Statuary Social Benefit and Labor’s right.

We found that our services have another name so-called PEO (Professional Employer Organization) Service.

For Thailand Local staff:

Service Coverage-for Thailand Local Employees:

* Recruiting contract

* asking-leave arrangement and over-shift processing complied with Thailand regulations

* Online Payroll Management System

* File for listing and delisting of Labor Insurance and Health Insurance

* Gross salary calculation based on fixed and non-fixed salary, Leave and Overtime

* Labor Insurance Charge paid by the company and employee

* Health insurance Charge paid by the company and employee

* Pension Fund Charge paid by the company and employee

* Withholding Tax

* Gross salary and net-cash salary

* Salary wire transferring services

* Delivering payment slip to each employee

* Accepting query from each employee.

* Annual accumulation salary income and withholding tax report to Tax Bureau.

* Year-end insurance premium certificate

* Severance pay application

* Semi-annual adjustment of insured caps and LPA caps.

* Laid-off arrangement complied with Thailand regulations.

Service processes-for Thailand Local Employees:

*Evershine will sign “Labor Contract “with your local staff based on the term of your Employment Contract. At that same time, Evershine will sign” Service Subcontract Agreement” with your company.

*Evershine will take care of these local employees complied with Thailand regulations on Tax, Statuary social benefits and labor’s right.

*Evershine will take care of payroll calculation and expenditure payment request of these local staff. Then let you approve each payment and monthly payment sheet.

*Evershine will ask your company to pay us the fund before we pay salary and expenses to your local staff.

*Evershine will take care of wiring process to your Thailand local staff.

*Evershine will take care of payroll compliance in Thailand.

*When lay-off these local employee, Evershine will take care of it complied with Thailand regulations.

Why clients use this Employment Outsourcing services to recruit Thailand local Employees ?

Timing

*When you need Thailand Local Staff help to do marketing or promotion for your products or services in Thailand.

*When you need Thailand Local Staff help to do product sourcing, supplier sourcing and quality assurance before shipping in Thailand.

*When you assign Thailand Local Staff to do Research and Development in Thailand.

*When you want to compete government bidding and need Thailand Local Staff to prepare bidding documents.

Advantages:

*Adopting Evershine “Temporary Employment Outsourcing”, you need not to maintain a legal entity which surely reduce company maintenance expenses.

*You can quickly to assign a person to reside in Thailand because this decision will not need through BOD resolution from your Parent company site.

*Of course you can withdraw your activities from Thailand very easily.

Disadvantages:

*Adopting Evershine “Temporary Employment Outsourcing”, when you pay us Expatriate cost of salary and tax-deductible employee expenses, it need to add up 7% Value Added Tax according to Thailand tax regulations.

*when you pay us Expatriate cost of Employee’s expenditures, if it belong non-tax-deductible expenses, it need to add up about 35% ( Income tax rate + Value Added Tax rate) according to Thailand tax regulations.

*That will increase your cost 7% ( Thailand VAT Rate) when comparing with executing payroll compliance by your own Thailand WFOE.

The conclusion is:

*When your employment is few people and short-term, you can adopt our Temporary Employment Outsourcing in Thailand.

*And when your operation become stable and long-term, you need to set up your own WFOE in Thailand.

*Remember we can provide payroll compliance services to you in both scenarios.

For Overseas Expatriates

Service Coverage-for Foreign Expatriates:

* Recruiting contract

*Work Permit Application recruited by Evershine

*RESIDENT CARD Application

*Arranging Pick-up in Tao-Yuan International Airport

*Arranging hotel or renting residence

*Arranging Trading center or Office renting

*Arranging opening bank account

*Arranging Cell Phone or Car renting

*Payroll Compliance

*Arranging Employees’ expenditure

*Annual Personal Income Tax when an Expatriates stay in Thailand over 183 Days in a year.

*Other local services

Service processes-for foreign expatriates:

*Evershine will sign “Labor Contract “with your expatriates based on the term of your Employment Contract. At that same time, Evershine will sign” Service Subcontract Agreement” with your company.

*Evershine will apply work permit and RESIDENT CARD for your expatriates.

*Expatriates will come to Thailand. Evershine will provide all relevant local service like airport pick-up, office arrangement, cell phone application, residence arrangement, bank account opening and medical insurance etc.

*Evershine will take care of payroll calculation and expenditure payment request of these expatriates. Then let you approve each payment and monthly payment sheet.

*Evershine will ask your company to pay us the fund before we pay salary and expenses to your expatriates.

*Evershine will take care of wiring process to your Expatriates.

*Evershine will take care of payroll compliance in Thailand.

Contact Us:

E-mail: yto2th@evershinecpa.com

Manager Cindy Victoria Speak in Bahasa, English, and Chinese.

Whats App +886-989-808-249

wechatid: victoria141193

Additional Information

Taipei Evershine CPAs Firm

6th Floor, 378 Chang Chun Rd.,Zhongshan Dist., Taipei City, Taiwan R.O.C.

Near MRT Nanjing Fuxing Station

Principal Partner :

Dale C.C. Chen

CPA in Taiwan+China+UK/ MBA+DBA/ Patent Attorney in Taiwan

Mobile: +86-139-1048-6278

in China ;

Mobile:+886-933920199

in Taipei

Wechat ID: evershiinecpa ;

Line ID:evershinecpa

skype:daleccchen ;

Linking Address: Dale Chen Linkedin

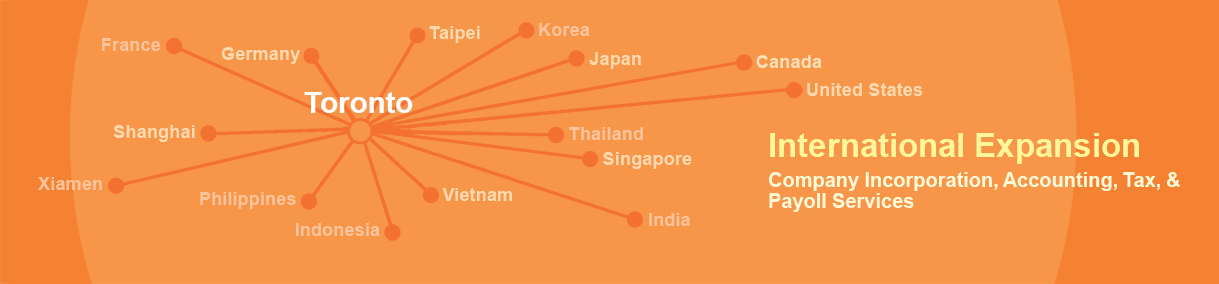

Evershine has 100% affiliates in the following cities:

Headquarter, Taipei, Xiamen, Beijing, Shanghai, Shanghai,

Shenzhen, New York, San Francisco, Houston, Phoenix Tokyo,

Seoul, Hanoi, Ho Chi Minh, Bangkok, Singapore, Kuala Lumpur,

Manila, Dubai, New Delhi, Mumbai, Dhaka, Jakarta, Frankfurt,

Paris, London, Amsterdam, Milan, Barcelona, Bucharest,

Melbourne, Sydney, Toronto, Mexico

Other cities with existent clients:

Miami, Atlanta, Oklahoma, Michigan, Seattle, Delaware;

Berlin, Stuttgart; Prague; Czech Republic; Bangalore; Surabaya;

Kaohsiung, Hong Kong, Shenzhen, Donguan, Guangzhou, Qingyuan, Yongkang, Hangzhou, Suzhou, Kunshan, Nanjing, Chongqing, Xuchang, Qingdao, Tianjin.

Evershine Potential Serviceable City (2 months preparatory period):

Evershine CPAs Firm is an IAPA member firm headquartered in London, with 300 member offices worldwide and approximately 10,000 employees.

Evershine CPAs Firm is a LEA member headquartered in Chicago, USA, it has 600 member offices worldwide and employs approximately 28,000 people.

Besides, Evershine is Taiwan local Partner of ADP Streamline ®.

(version: 2024/07)

Please contact us by email at HQ4yto@evershinecpa.com